Leeds provides free tax assistance to qualified taxpayers in the community

MEDIA CONTACT

Leeds School of Business Support Desk

University of Colorado Boulder

Telephone: 303-492-6654 (information number only)

Free Tax Assistance Offered by Leeds School of Business Students

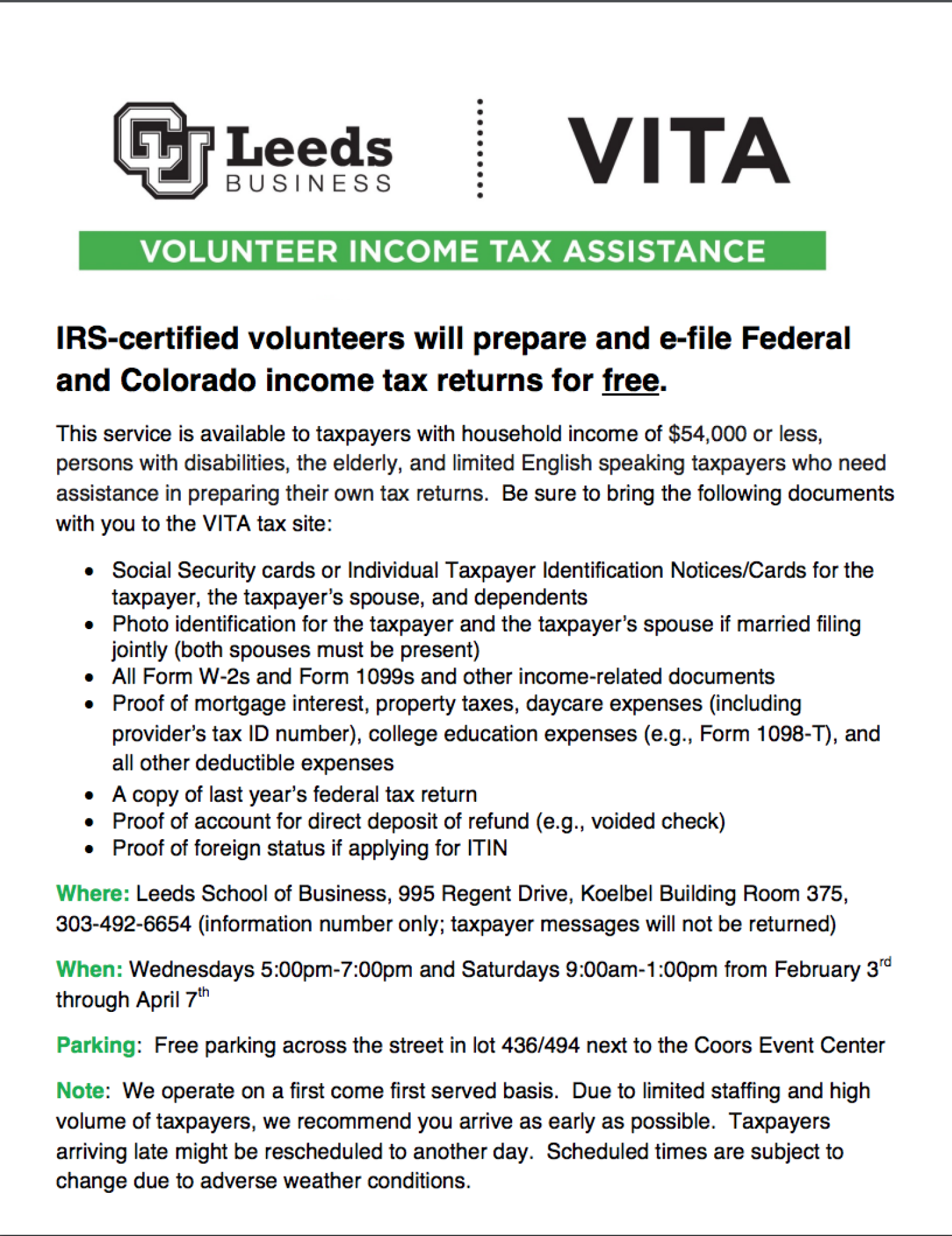

Jan. 30, 2018—The Leeds School of Business at the University of Colorado Boulder is offering free tax preparation services to taxpayers with household income of $54,000 or less, persons with disabilities, the elderly, and limited English speaking taxpayers who need assistance in preparing their own tax returns.This is the ninth year that Leeds has provided this free tax service to the community.

Leeds School of Business students who have passed an IRS certification exam will prepare tax returns for qualified taxpayers. To ensure accuracy and completeness, all student-prepared tax returns will be reviewed by community volunteers who are experienced in tax law.

Students receive valuable experience preparing tax returns, and they are able to work directly with taxpayers. This hands-on work experience is well received by potential employers, and participating in the Volunteer Tax Assistance (VITA) program gives students an opportunity to perform a much-needed community service.

Last year, Leeds School students prepared approximately 475 tax returns and obtained $461,000 in refunds for taxpayers. The students also placed an extra $155,000 into the local economy through Earned Income Tax Credits for families. VITA operates on a first-come-first-served basis. There are no appointments. Due to limited staffing, taxpayers should arrive as early as possible. Taxpayers arriving late may be rescheduled to another day. Times are subject to change due to adverse weather.

When:

Wednesdays 5:00 p.m.-7:00 p.m.

Saturdays 9 a.m.-1:00 p.m.

Feb. 3-Apr. 7

Where:

Room 375

Koelbel Building, 995 Regent Drive, Boulder

Free parking is available in the parking garage across the street.

Eligible taxpayers should bring the following to the tax site:

- Social Security cards or Individual Taxpayer Identification Notices/Cards for the taxpayer, the taxpayer’s spouse, and dependents

- Photo identification for the taxpayer and the taxpayer’s spouse if married filing jointly (both spouses must be present)

- All Form W-2s and Form 1099s and other income-related documents

- Proof of mortgage interest, property taxes, daycare expenses (including provider’s tax ID number), college education expenses (e.g., Form 1098-T), and all other deductible expenses

- A copy of last year’s federal tax return

- Proof of account for direct deposit of refund (e.g., voided check)

- Proof of foreign status if applying for ITIN