Intellectual Property (IP) Management

Researchers, inventors and creators should submit a disclosure of any invention or copyrighted material before publishing it to ensure its protection.

Early announcements or publications, whether written or spoken, can jeopardize the protection and commercialization of your invention or copyrighted material. Establishing personal contact and submitting a Disclosure Form quickly is a crucial first step.

Intellectual property (IP) is any innovation, creative work or discovery that can ultimately be filed as a patent, copyright or trademark to secure ownership and anchor opportunities for commercialization. IP is a critical part of bringing innovations out of the University of Colorado and into the market.

For researchers, inventors and creators at CU Boulder, CU Denver (except CU Denver investigators in the biosciences, who should work with CU Innovations) and UCCS, Venture Partners is here to support innovators in implementing a strategy for their IP with which they share ownership with the university, under university policy. Venture Partners manages and funds IP for hundreds of university inventions each year, and the University of Colorado System is among the top universities in the world for issued patents.

Is Your IP Supported by Venture Partners?

Your IP may be supported by Venture Partners if it meets the following criteria:

- You are employed by CU Boulder or UCCS

- You are employed by CU Denver and your IP is not related to biosciences (in which case you should work with CU Innovation)

- Your copyrightable or patentable technology was created using funding or facilities at the University of Colorado

Disclosing an innovation is required for proper compliance with sponsored research and university policy.

Employment includes but is not limited to, those receiving salaries, scholarships or fellowships and part-time and student employees.

Disclosing an innovation allows the IP management team to review it for support and the application of CU’s IP Policies, but it does not impact the IP's real ownership.

Your IP may not be supported by Venture Partners if it meets the following criteria:

- You are a student or employee of the university but did not use university funding or facilities to create your IP.

- You are a student, and your IP was created solely to satisfy a course requirement, with no signed pre-conditions.

- You are employed by CU Anschutz; check out CU Innovation for more information about IP Management.

- You are employed by CU Denver and your IP is related to biosciences; check out CU Innovation for more information about IP Management.

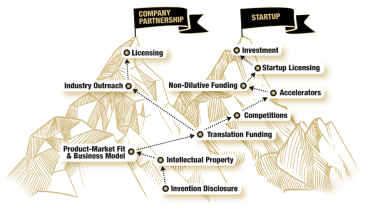

Explore what we can do together

But What is "Commercialization?"

The path to commercialization—also known as "research translation" or "tech transfer"—can be challenging, so Venture Partners unites industry partners, entrepreneurs and investors to help researchers, inventors and creators at the University of Colorado bring their groundbreaking discoveries into the marketplace.

IP and Licensing Team

Would you like Venture Partners to meet with or give a presentation to your organization or department? Please email vpcontact@colorado.edu.

For general inquiries about IP management, please email vpcontact@colorado.edu.