Internal Sales Activity

Other Resources

- Rate-Based Service Activities | BFP

Provides rate sheets, resources and guidance regarding rate-based sales of goods and services from campus units to internal and external customers. - Service Activities | OCG

Information and guidance regarding service activities performed by university personnel using university facilities and/or equipment. - ID Revenue Accounts and ID Expense Accounts

ID accounts (revenue & expense) must be used to record sales of goods and services between departments in certain circumstances. - Internal Sales Activities | The Guide Ch. 13

Provides guidelines for establishing, costing, pricing and administering sales between internal departments. - Questions or Comments?

campus.accounting@colorado.edu

Internal sales activity is defined by a CU Boulder policy that provides guidelines for establishing, costing, pricing and administering sales and the sale of services between internal (CU system-wide) departments.

Specifically, certain goods and services are most effectively provided within the university, although those same goods and services may be available commercially. The ISA controls the cost of providing the goods or services and the charge system is applied uniformly and in compliance with government regulations. Under the internal sales activity, revenue account codes are set up by fund type.

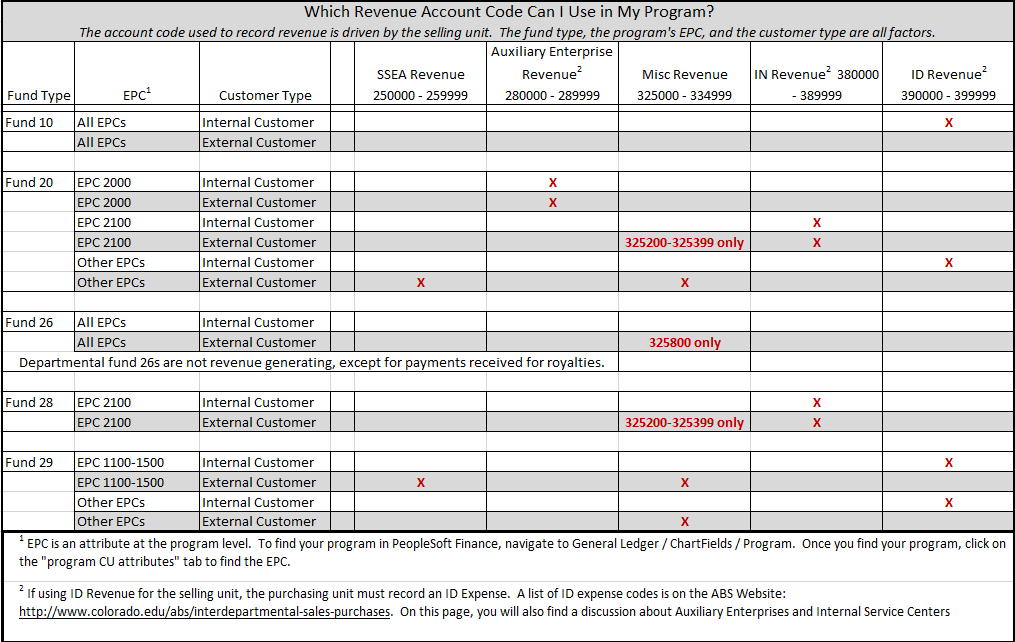

See the below chart for specific revenue account codes:

Download revenue account code chart.

EPC is an attribute at the program level. To find your program in PeopleSoft Finance, navigate to general ledger > chartfields > program. Once you find your program, click on the "program CU attributes" tab to find the EPC.

If using ID revenue for the selling unit, the purchasing unit must record an ID expense. More information about auxiliary enterprises and internal service centers is below.

ID Account Overview

Per GASB, the correct revenue and expense accounts must be used whenever one campus department purchases goods or services from another campus department. Specifically, for every transaction in which the selling department is not categorized as either an auxiliary enterprise (EPC 2000) or an internal service center (EPC 2100), the departments involved must use an ID account on the purchasing document. The ID refers to interdepartmental transactions.

- ID accounts must be used on both the expense and revenue side of the transaction.

- Sales to fund 80 FOPPS cannot use the ID revenue and expense account coding.

To assist departments in complying with this requirement, a list of auxiliary enterprise and internal service centers are available below. Whenever a campus department makes a purchase from a department that is not included on either the auxiliary enterprise or internal service center list, one of the ID account codes must be used. When making a purchase from an auxiliary enterprise or an internal service center, use a regular expense account as though the purchase were being made from an off-campus vendor.

Auxiliary Enterprise List CU-Boulder (EPC 2000) (NACUBO Enterprises)

When departments make a purchase from one of the Auxiliary Enterprises on this list (EPS 2000) below, they do not use an ID Account. Instead, use a regular expense account as though the purchase were being made from an off-campus vendor. The revenue is recorded in auxiliary enterprise revenue accounts 280000–289999.

- NACUBO Auxiliary Enterprises: Dept Names/Operations (EPC 2000)

- Book Store

- Facilities Management - Real Estate

- Facilities Management - Research Park

- Housing and Dining Services (excluding Housing - Conference Services)

- Athletics

- Safety - Parking and Transit Services

- Research Property Services