Corporate Risk Reporting and Indigenous Peoples: The International Sustainability Standards Board

The current system of voluntary-reporting frameworks used by organizations around the world to report and disclose financially material information is composed of multiple and varied reporting frameworks. This complex system can cause confusion for investors or reduce transparency and accountability across sectors and markets. In an effort to harmonize these varying frameworks, a system of international bodies has emerged to tackle these issues – one of the results being the creation of the International Sustainability Standards Board (ISSB).

The formation of global standards presents an opportunity to integrate Indigenous rights in a new and integral manner. One way the ISSB can fulfill its objective of creating a more equitable and profitable environment for global investors and market participants is to capture Indigenous rights risk in alignment with the United Nations Declaration on the Rights of Indigenous Peoples (UNDRIP). This article looks at the formation and function of the ISSB and ways Indigenous Peoples can get involved.

What is the International Sustainability Standards Board?

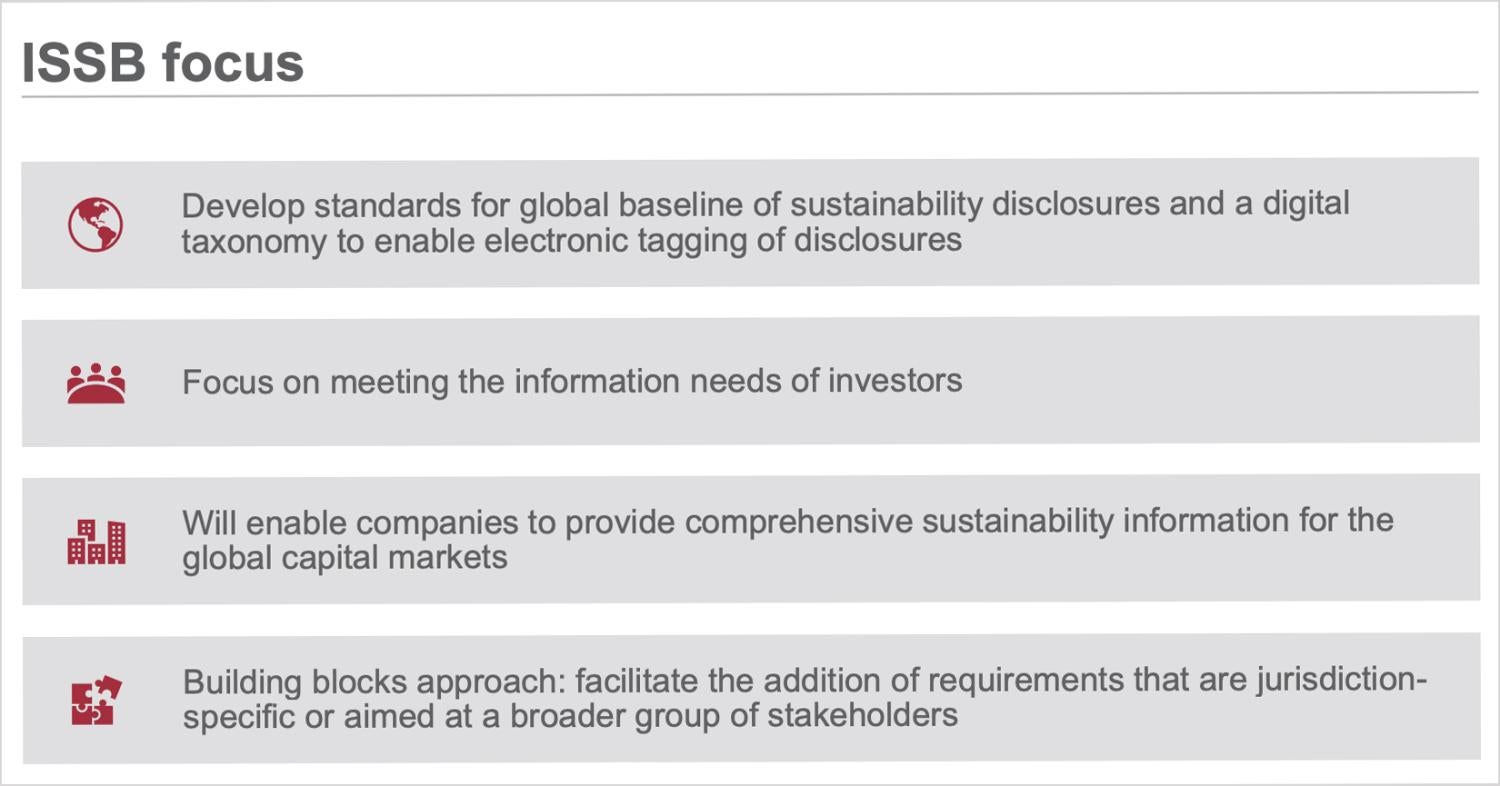

The ISSB is an international sustainability standard-setting body governed by the International Financial Reporting Standards Foundation (IFRS). On November 3, 2021, the IFRS created the ISSB at COP26 in Glasgow, where the gathered countries agreed to accelerate efforts to reach net zero, to phase out fossil fuels, and to declare that the transition to a low-carbon economy must be a just transition. Created to function in the public interest, ISSB is tasked with developing standards that establish a cumulative, high-quality, and global set of sustainability disclosures focused on meeting the modern needs of investors and financial markets.

To achieve this goal, ISSB intends to build on the work of existing investor-focused reporting initiatives, including the Climate Disclosure Standards Board, the Task Force for Climate-related Financial Disclosures (TCFD), the Value Reporting Foundation’s Integrated Reporting Framework, the SASB Standards, and the World Economic Forum’s Stakeholder Capitalism Metrics.

What are the ISSB Standards?

The ISSB standards cover financially material sustainability topics within environmental, social, and governance (ESG) frameworks. “Financially material” refers to quantitative information that is reasonably likely to impact an investor’s decision and therefore must be included in financial statements. This differs from “impact materiality”, which encompasses disclosures such as those the Global Reporting Initiative (GRI) produces that ask organizations to disclose how their operations impact the economy, the environment, and people and are more qualitative in nature.

Working towards a formal standard, ISSB has released exposure drafts on the general requirements for sustainability-related financial information and climate-related disclosures. By building on the existing sustainability reporting frameworks, the ISSB standards seek to represent a singular source for clear, measurable, and consistent sustainability-related financial information for investors and markets around the world. The objective of the ISSB standards then is to create a singular global standard for sustainability-related financial disclosures, which makes it imperative that Indigenous human rights are included.

How Indigenous Peoples are Relevant to the ISSB Standards

All development must account for any impact to Indigenous Peoples. Indigenous rights violations present financially material risks to companies and can substantially inform investment decisions and impact a company’s bottom line.

As the material and reputational losses experienced by the companies behind the Dakota Access Pipeline show, Indigenous human rights violations can be costly to corporations when left unaddressed and more so if shareholders are not made aware or have limited knowledge of the risk companies face as related to development on or near Indigenous territories.

Additionally, Indigenous Peoples stand to be significantly impacted by the rush to secure the critical minerals necessary to fuel the transition to a low carbon economy. In light of this global energy transition, organizations across multiple sectors representing multiple industries will encounter Indigenous rights risks at some point in the course of their operations.

If ISSB is to be the global standard for sustainability and climate-related financial reporting, it must consider risks related to Indigenous human rights as codified in UNDRIP. If ISSB omits such considerations, investors will not have the full picture of a corporation’s sustainability and climate-related risks.

How Indigenous Peoples Can Engage with the ISSB Standards

ISSB encourages public participation in the comment process. When ISSB releases an exposure draft, it provides two ways of engaging and providing feedback – a survey and/or a comment submission box. Indigenous Peoples can utilize either of these methods to provide feedback and contribute to the iteration of ISSB standards, arguing for specific and/or thematic considerations of Indigenous Peoples’ human rights and risk in the emerging standards.

According to ISSB, comments are most useful if they: address the specific questions asked in an invitation to comment; contain a clear rationale for the views expressed and provide related evidence; and include any alternatives that we should consider, if applicable. Importantly however, comment letters need not answer all the questions in an exposure draft to be considered as having provided helpful input.

As the ISSB works to create a system of global uniform reporting standards, Indigenous Peoples and socially responsible investors must participate and advocate for the inclusion of Indigenous Peoples human rights in the forthcoming standards. This is an important and timely mechanism for forwarding Indigenous human rights in the corporate reporting space. If Indigenous risk considerations are not present in these standards, this lack of inclusion would hinder ongoing efforts to harmonize emerging sustainability business principles with respect for Indigenous human rights. Moreover, if organizations are not required to report the impact of Indigenous rights violations, or the likelihood of such impacts occurring, investors and markets will continue to be misled as to the presence of material financial risk attached to projects or development that proceed without FPIC and violate Indigenous human rights.